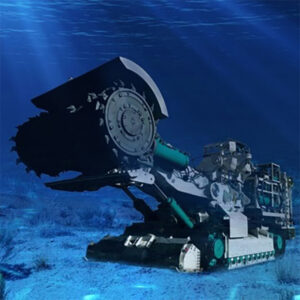

The Metals Company will source metals from polymetalic rocks, found in deep oceans.

Mining the seafloor for key minerals and metals could negatively impact the industry, resulting in $500 billion of lost value and causing damages to the world’s biodiversity estimated to be up to 25 times greater than land-based mining, a new report published Thursday shows.

The quest for substitutes for fossil fuels has increased the need for metals used in the batteries that power electric vehicles (EVs) and in green-energy applications. Minerals and metals such as cobalt, nickel, copper and manganese can be found in potato-sized nodules on the ocean floor. Reserves are estimated to be worth anywhere from $8 trillion to more than $16 trillion and they are in areas where companies, including deep-sea mining pioneer The Metals Company (NASDAQ: TMC), plan to target.

According to the report, entitled “How to lose half a trillion” by non-profit Planet Tracker, extracting metals from the seafloor could cost the mining industry $30 to $132 billion in value destruction.

François Mosnier, head of Oceans and report lead author at Planet Tracker, told MINING.COM this estimate is the result of adding the combined value loss the activity would cause for both ocean floor and terrestrial miners.

“For the deep sea mining sector, focusing only on polymetallic nodules in international waters, the cost would reach $35 billion-$49 billion of value destruction,” Mosnier said.

“This amount was computed based on the estimated invested capital in the sector in 2043 ($115 billion), the industry’s estimated return on invested capital (-2%) and the industry’s weighted average cost of capital (WACC) and long-term growth (3%).”

Put simply, the deep-sea mining industry would not beat the cost of the capital it requires to exist, he said.

“Before factoring in any environmental impacts, the economics already appear uncompelling,” Mosnier said. “High operating expenditures mean that returns will be negative for investors in deep sea mining, which will also destroy value in other sectors, such as terrestrial mining and fishing.”

On top of that, major global banks such Credit Suisse, Lloyds, NatWest, and Standard Chartered, Dutch bank ABN Amro, and Spanish group Banco Bilbao Vizcaya Argentaria, have all introduced policies that rule out funding deep-sea exploration and extraction.

The report highlights the positive financial impact of respecting nature as sectors dependent on preserving intact ecosystems have outperformed those exploiting resources threefold over the last three decades.

It also urges investors to focus on nature preservation rather than resource extraction a repeats its call for a moratorium on deep-sea mining.