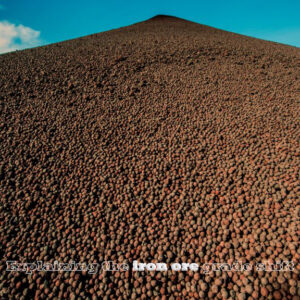

The global iron ore market is in the midst of a major pricing shift, moving away from the long-standing 62% Fe benchmark toward a new 61% Fe specification.

The change, driven by a gradual decline in ore grades and higher impurity levels, is reshaping both the physical and financial sides of the industry and raising big questions about how iron ore is valued.

Argus media has launched a dedicated 61% Fe index alongside its 62% Fe benchmark. This allows for direct valuation of the new grade while maintaining clarity around quality differentials.

Why the change matters

For decades, the 62% Fe grade served as the anchor for global pricing, with Pilbara Blend Fines (PBF) acting as the bellwether. But as mined grades have steadily dropped, the 62% benchmark no longer matches what is actually traded. The move to a 61% Fe baseline, effective from 2026, reflects this reality.

The Singapore Exchange (SGX) has proposed iron ore futures — which see volumes more than three times larger than the physical market — to still be tied to the old specification, but with a one-off price adjustment in September to bridge the gap. This would preserve liquidity in the contract, but traders say it complicates valuations and adds basis risk.