The European steel market is preparing for significant changes in 2026. We see that the role of CBAM as a technical barrier is growing, which could reduce imports in the first quarter by 20-30% y/y. The new tariff quota system, which is expected to come into force in July 2026, provides for a 43% reduction in quotas, but import volumes may fall even further – by 50% y/y and more.

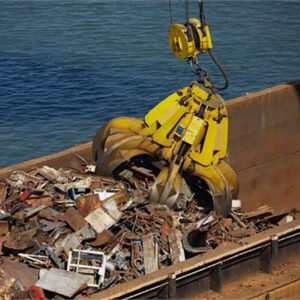

Under these conditions, European producers will need to increase steel production by 13–14% next year to compensate for the reduction in market supply while maintaining stable demand. This will require an additional 8 million tons of scrap, which is a rather sharp jump for the industry.

Assuming exports remain at this year’s level (17 million tons), scrap collection in the EU is expected to increase from 87 million tons in 2025 to 95 million tons in 2026. The European industry already experienced such growth in demand for scrap in 2017 and 2021, but this was accompanied by price increases. What consequences will this have for the scrap market both in the EU and globally?

Let’s look at the chart, as collection volumes and prices are closely linked. Particularly telling is the new normal in the scrap metal market in 2022-2025, which differs significantly from the 2015-2021 period, showing higher prices for similar volumes of scrap.